This article is your comprehensive guide to understanding and using Re-Leased Pay, a feature designed to simplify the way you receive online payments. By integrating with Stripe, a trusted global payments processor, Re-Leased Pay provides a seamless, secure, and efficient way to handle transactions, making rent collection more convenient for both property managers and tenants. Below we unpack how Re-Leased Pay works, who can use it, and the benefits it brings to your property management.

How Re-Leased Pay Enhances Your Payment Process

Re-Leased Pay offers a seamless online payment option for rent and other property-related charges. Through this service, you’ll spend less time on credit control and chasing arrears, while tenants enjoy the convenience of online payments and card loyalty rewards.

Setting Up Re-Leased Pay

For customers using Client/Trust Accounting or as Standalone:

- Create your Re-Leased Pay account.

- Add the Pay Online button to your invoice templates.

- Tenants can then pay via Re-Leased Pay.

- The invoice is automatically marked as paid in Re-Leased based on your payment recognition settings

- Stripe processes the payment securely before it's paid out to your bank account.

- Enable automatic reconciliation following the pay-out schedule.

For customers using an external accounting package:

- Ensure your Re-Leased Pay account is active.

- Invoices sent will feature a Pay Online button, using a provided template or a custom one.

-

The above steps 3 to 6 are then followed as described.

Eligibility for Re-Leased Pay

Supported regions for Re-Leased Pay currently include Australia, New Zealand, United States, Canada, the United Kingdom, and Ireland. It's available to all companies within these regions, regardless of whether you use an external accounting package or Client/Trust Accounting.

At present, you can only accept the currency of the country your company is in.

Re-Leased Pay Account Setup Requirements

An administrator within Re-Leased is required to initiate the setup process, with additional company and business owner details necessary for completion. The individual responsible for setting up Stripe must either be the legal entity owner or a representative authorized to act on behalf of the entity. For guidance on why personal information like a Social Security Number may be requested by Stripe, please refer to Requirements for SSN in Re-Leased Pay

Accepted Payment Methods via Re-Leased Pay

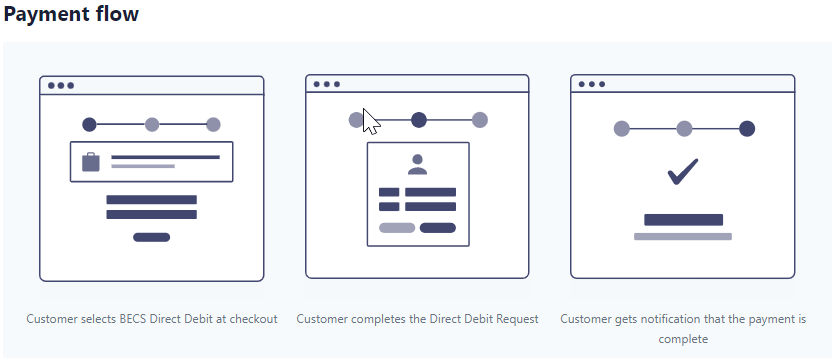

Re-Leased Pay allows tenants to pay their invoices with credit or debit cards. Additionally, tenancy-initiated Direct Debits are available in all supported regions, with the only exception being New Zealand.

Our Payment Gateway Partner: Stripe

Re-Leased has aligned with Stripe, a leading global payment provider known for its reliability and security, to handle your transactions. This partnership ensures that your financial interactions are managed professionally and securely.

Social Security Number for Stripe: " This information is required as part of Stripe’s mandatory identity verification requirement: Stripe must collect, verify, and maintain information on the individuals associated with every US Stripe account, as required by our regulators and financial partners. This is intended to promote transparency and prevent individuals from using complex company structures to hide terrorist financing, money laundering, tax evasion, and other financial crimes." - Stripe support.